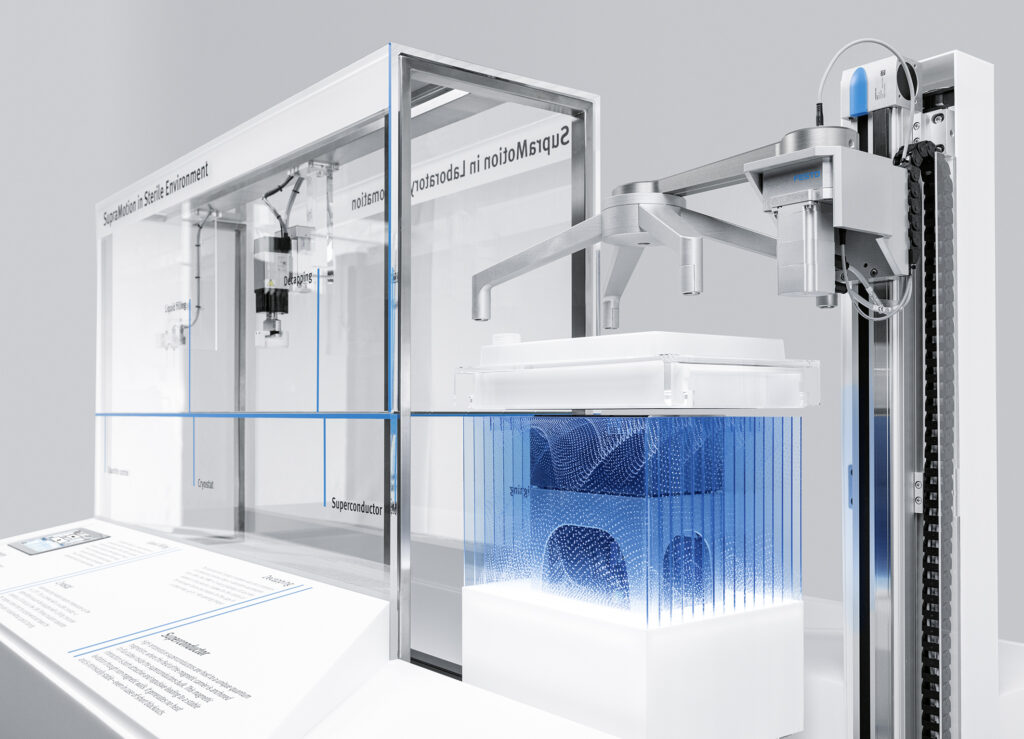

Over the last year, Design World has tracked several persistent and emerging trends that build on the last decade’s innovations. With some notable exceptions, many of the core technologies employed in motion systems and automation are familiar. Yet, propelled by the radically increased capabilities of electronics and software, these core technologies have catapulted the design-engineering space into new application arenas. Just one example is the Festo SupraMotion …

The trends towards increased digitization and interconnectivity continue, as do efforts towards digital-transformation (DX) initiatives based on cloud-based analytics. For motion systems and automation, such programs offer real-world uses for realtime monitoring, adaptive predictive maintenance, and self-optimizing controls. Visit designworldonline.com/trends for some perspective on past years’ steady march to the current state of the industry.

At the recent MD&M ATX West tradeshow in Anaheim, Calif., many discussions covered the introduction of ever-tinier components. These include precision planetary gearing with gears ∅2 mm and smaller, NEMA-stepper actuators (to NEMA 6), dc micromotors (especially slotless motors to below ∅11 mm), dime-sized power supplies and drives leveraging new proprietary forms of heat shedding, and linear bearings to 2 mm wide. Manufacturing such technology necessitates the use of precision modeling and machining, micro-molding, and additive-manufacturing processes capable of producing minuscule parts with top accuracy.

Medical-device manufacturing continues to drive demand for these kinds of tiny motion components to complement disposable equipment, implantables, and high-precision components as for fluid metering and heart-valve control. In addition, all need cleanroom manufacturing demanding it own unique lineup of motion systems.

However, smaller components and cleanroom manufacturing aren’t only for medical devices. The semiconductor and aerospace industries make heavy use of many of the same technologies.

When designs are especially small, they’re usually one-of-a-kind. Here, manufacturers often eschew off-the-shelf products for custom assemblies. So, it’s no wonder motor, gearing, and other motion-component suppliers are continually increasing emphasis on early involvement in customer projects needing tailored solutions. This trend began years ago and the approach has come to dominate in industries solving unusual design challenges.

Acquisitions and the consolidation of motion-component companies have been around since time immemorial, and is no trend at all. That said, the past year saw many more businesses merge to offer comprehensive motion-solution portfolios. Many brands specializing in power transmission, precision motion control, and mechanical components are now in the Nidec, Regal Rexnord, Timken, ABB, and Designatronics families.

This industry consolidation means in many cases, design engineers can (at least in theory) source components and subsystems from technology-agnostic suppliers. For example, OEMs in the robotics space can now get strain-wave gearing, planetary gearing, and cycloidal gearing from single sources that in many cases offer motor integration as well. This is helpful where a given six-axis robotic design employs all three gearing types.

As covered many times in the past by Design World, engineering teams are often short-staffed (in some cases assuming motion system design work outside a core area of expertise) so all global suppliers are touting and promoting their customization and system-integration services. Some also underscore the importance of digital accessibility of product data and specifications in the form of CAD files (including those generated on the fly from online configurators) and freely available online product information.

In a related trend, there continues to be a global labor shortage specific to skilled workers for manufacturing and qualified machine operators. Especially in the U.S., the labor market is facing challenges due to an aging population and (some would argue) insufficient support of national trades-related apprenticeship and internship programs.

All this has driven new investment in training programs as well as the adoption of automated solutions — especially for machine tending and assembly tasks. Though geopolitical developments could change overall business trends, many companies in automation have recently expanded operations or plan for expansion of physical facilities as well as reach into international markets.

More specifically, the Southeast U.S. continues to see onshoring and other investment in new automotive and EV manufacturing, while the Midwest is seeing expansion of advanced manufacturing of motion components and robotics as well as traditional and EV automotive manufacture.

Meanwhile, the West Coast and Northeast continue to leverage existing networks to drive software, consumer electronics, robotic, and biotech and medical-device development and manufacture.

Thanks in large part to the CHIPS Act, the Southwest (led by TSMC, Texas Instruments, and Samsung) has benefited from expanded semiconductor manufacture with new chip-fabrication facilities. One caveat here: As reported by Design World Editor-in-Chief Rachael Pasini, the Semiconductor Industry Association predicts that while 114,800 new jobs will be created in the U.S. semiconductor industry by 2030, more than half of those jobs to go unfilled. Visit designworldonline.com and search Chips Act for more information.

Since the COVID-19 pandemic, the U.S. has also seen a surge in the use of laboratory automation. The latter is helping meet high-throughput testing demands, minimize the effect of human error on workflows, and speed the pace of life-sciences and pharmaceutical research. Employed here are precision motion systems (including compact Cartesian motion designs), robotic arms, and software leveraging AI.

With all the buzz surrounding these markets, let us not forget how the packaging industry around the globe also continues to drive technology trends. By most estimates, U.S. packaging is a $240B industry — a large piece of the $3T manufacturing as well as the $2.3T logistics and services industries.

In fact, packaging machinery has become increasingly adaptive with modularity, controllability (via DX connectivity), and the safety, efficiency, and global networking standards. Today’s packaging equipment also leverages motion and mechanical mainstays with control software and electronics enabling accuracies, speeds, and other performance characteristics impossible just a decade ago.

While the comparable size of the packaging industry could recede with the renaissance of U.S. semiconductor manufacturing, it will continue to drive innovation to meet high throughput, sustainability, and flexibility objectives.

Leave a Reply

You must be logged in to post a comment.