In a recent phone interview, we got to chat with Warren Osak, CEO of Toronto-based Electromate Inc. — a distributor founded in 1986 that focuses on electromechanical motion control. More specifically, Osak’s company sells primarily servo systems and stepper systems — often for demanding or challenging applications requiring high precision, accuracy, and bi-directional repeatability. Electromate also specializes applications destined for harsh environments and high duty cycles. Here’s what Osak had to say about current trends in the motion industry.

Lisa Eitel • Design World: One trend we see is an uptick in both traditional stepper-motor applications and those for hybrid steppers … especially in robots and medical applications.

Osak • Electromate: In the field of stepper motors, it’s a tale of two technologies. On one end of the spectrum, you have low-end steppers … and these can take the form of tin-can stepper motors (also known as can-stack stepper motors) that output rotary or linear motion. For the latter, the motor often incorporates an acme screw instead of an output shaft. Such technology is low cost and highly customizable — but there’s a lot of price pressure in this marketplace.

On the other end of the spectrum are integrated stepper motors. These have servo-like performance by closing the position loop around a feedback device such as an encoder. Plus, anti-resonance circuitry built into these stepper motors can ensure smooth acceleration between 50 and 500 Hz.

We see the middle of the market — actuated by the traditional 1.8° hybrid stepper motor as a standalone device — kind of going away. Technology is either migrating upward (and taking the form of integrated motors or smart motors) or migrating downward — to lower-cost motors with less sophisticated structures. More specifically, the use of traditional hybrid stepper motors has been yielding to integrated products … while in lower-end applications, we see more use of less-sophisticated motors with customer-provided integrated chips (ICs) to drive them.

Eitel: Battery-powered equipment is proliferating — especially in the form of ATVs, AGVs, drones, and service robots. What are the design challenges here?

Osak: For embedded robotic applications, we’re seeing a lot more 48-V and 24-V designs … and even some 12-V applications. Note that when I say embedded robotic, I’m talking about frameless motors — the brushless motors that run off low voltage and directly integrate into the wheel drives of AGVs, ATVs, and utility-task vehicles. In our marketplace, size requirements are increasingly challenging — with torque-density requirements also increasing … and that’s especially true for motion designs that run off low-voltage battery-operated systems.

Eitel: No conversation about trends is complete without some discussion of IIoT. What are your thoughts?

Osak: IoT has been a buzzword over the last few years, and we see a lot of IoT connectivity in the HMI and automation-control space … where HMIs connect on fieldbus networks to enterprise networks and other systems outside the motion design — including vision systems, supervisory control systems, and SCADA systems. All of these are increasingly interconnected — primarily through HMI devices with full IoT (Industrie 4.0) connectivity. But we’re not seeing a proliferation of IoT devices on the motion-control side of things — in motion controllers or programmable automation controllers, for example. I believe that adoption will come, but right now we’re not seeing it.

Today’s localized motion controllers or distributed controllers primarily handle I/O and not vast data processing and analysis … as they’re still task-specific motion-system components. In contrast, at the HMI level there’s much more networked manufacturing I/O.

Eitel: Do you see more OEMs wanting turnkey motion solutions?

Osak: There’s definitely continued push for more integration, and our customers often want to tie their machine controls into our motion control for a unified integrated solution — programmable under one language. That said, we don’t see individual component providers going away, as there will always be need for bespoke and best-of-breed manufacturers that build custom products for custom applications.

Eitel: Anything you’re seeing in design miniaturization that impresses you?

Osak: There have been big advancements in the construction of servomotors. The physics of optimizing the magnetic flux generated from rare-earth magnet assemblies (and new production techniques) have leveraged improvements in motor designs. So, we’re seeing continued improvement in the torque density of servomotors well beyond what I once believed achievable.

In layman’s terms, the torque output one could get out of a NEMA-34-frame servomotor from eight or 10 years ago is now achievable with a NEMA-23-frame servomotor. In the same way, torque output of a NEMA 23 frame servomotor from eight to 10 years ago is now what today’s NEMA-17-frame motors can produce. So motors are definitively more power dense than in the past — and in fact for a given package size, there’s 50 to 100% increase in torque output versus motors produced a decade years ago.

What’s more, miniaturization is going to continue, because miniaturization imparts better use of space, reductions in mass, and reductions in cost — so I don’t see a point of diminishing return. Of course, there will be a point at which we get diminishing returns — where gains in servomotor construction simply don’t boost torque output appreciably — but we haven’t gotten there yet.

Eitel: Anything you’re seeing that’s prompting new uses for linear-motion technologies?

Osak: We’re seeing adoption of roller-screw actuation devices, which are more efficient than traditional forms of actuation (such linear bearing systems and round-rail bearing systems paired with ballscrew and acme screw drives). Increasing linear servo-actuator efficiency in turn allows design engineers to use more compact (yet higher thrust) actuators in applications traditionally driven by hydraulic actuation. In fact, electric linear actuators with roller-screw drive mechanisms can in some cases replace hydraulic drives even in very high-powered systems.

Eitel: Onto the topic of fluid power … what’s your take on servo-pneumatic designs?

Osak: We don’t sell any pneumatic systems, so I can’t comment on that directly … But I can say we get feedback from customers who want reliable solutions with longer mean time between failure (MTBF) — and a reduction in part count is a great way to get a higher MTBF. Because electrically driven servo actuators have fewer parts than pneumatic or hydraulic systems, they ultimately need (in theory at least) less downtime.

Eitel: Do you see any products that incorporate advanced materials to boost performance?

Osak: We see increased use of ceramics in gearing technology — with a few gearbox manufacturers now replacing case-hardened and steel and alloy gears with ceramic gears. We’re also seeing ceramic shafts and bits (such as pins) in gearboxes as well. Ceramic has a lot of unique properties — the most important being noise reduction. So in fact, planetary gearboxes with ceramic internals are half as noisy as traditional planetary gearheads … and they have a lower coefficient of heat expansion, so exhibit less stress than metal alloys when hot. Because ceramic components don’t expand as much, they also have tighter backlash and runout tolerances than comparable internals made of metal.

Eitel: This is news to me — because I primarily associate the use of advanced ceramics with rotary bearings.

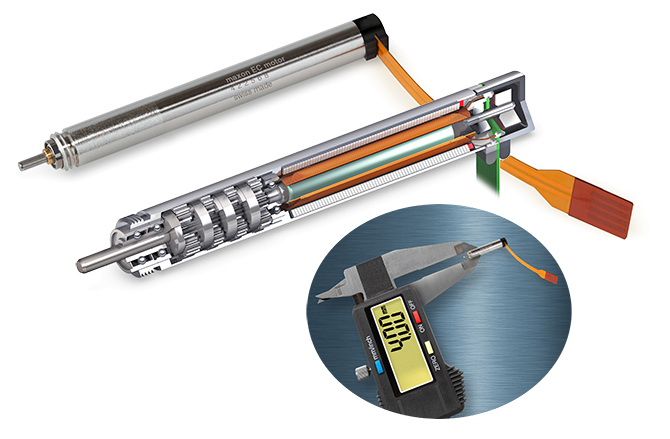

Osak: Well, consider maxon precision motors. If I had to give a very rough guesstimate, I’d say 10% of all their gearbox products we see now have ceramic internals. They have a division that manufactures ceramic injection molding (CIM) and metal injection molding (MIM) gearbox internals for high-performance gearmotor designs. These include low-moisture gearboxes, low-backlash gearboxes, and high-torque gearboxes. Ceramic subcomponents definitely make sense in smaller-frame motors — especially those destined for medical applications where minimization of noise and vibration (and high load capacity) are critical.

Eitel: What technologies for motion control are currently showing the most innovation?

Osak: Sensor technologies seem to be advancing about twice as fast as other components used in motion-control systems. New developments for feedback devices also outnumber those for servo drives, rotary actuators, linear actuators, and motors — and I don’t know why that is. There’s certainly a lot of cutting-edge R&D in the world of feedback devices … so the pace of advancement in encoder, resolver, and linear variable differential transformer (LVDT) designs has just been astounding.

Eitel: We see electronics improving sensing and motion feedback.

Osak: Yes — and even with all this new technology, the price for feedback is coming down — it’s unbelievable. Just to give real-world example: Traditionally a design engineer would buy a motor and specify encoder resolution — and (whether incremental or absolute) encoder resolution was preset. But sometimes after that motor or servo actuator was deployed, you’d realize more (or less) resolution was needed. So what do you do? In the past, you had to buy another motor … or (in some rare cases) you could send the motor back, and the supplier would fit a different encoder.

Well today encoders can be field programmable. So you can buy an encoder … and if you think you need more resolution, you just program it (while it’s still in the field) with a handheld device. How cool is that? The ability to program an encoder for an application in the field in 30 seconds or less — without a pre-specified resolution — also means you can stock a supply of one given encoder model and just pull them off the shelf for programming as they’re needed. So design engineers have a lot more flexibility to standardize.

In fact, this is just the tip of the iceberg. Some encoders even include ASICs to allow more than just the programming of resolution. Some linear encoders even let end users program for pitch, N+1 feedback, and redundant feedback.

Eitel: Posital Fraba comes to mind here, as they sell very configurable encoders.

Osak: We sell Posital Fraba products, including encoders that have multiple tracks: One feedback signal is absolute, and one feedback signal is incremental, but they come from the same device. Each signal can be at a different frequency range and a different resolution. Electronics enable all this functionality and (in a lot of cases) field programmability. In short, this manufacturer listens to engineers and identifies their requirements … and then comes out with specialized product to meet those requirements. That differs from the “build it and they will come” motion-manufacturer mentality. So Posital Fraba manufactures more than a million encoder varieties — literally more than a million — and each is one customizable to each specific customer requirement.

Leave a Reply

You must be logged in to post a comment.