Clutches and brakes hold, stop or index loads in motion designs. Especially over the last five years, a trend toward application-specific components has quickened as several industries push the performance envelope of stock parts. So, we asked industry experts about this and other trends spurring clutch and brake innovation. The biggest growth in industrial clutch and brake use is for power-off brakes, because production automation—steadily rising—requires many holding brakes. More after the jump.

“Over the years, there’s been a gradual increase in the use of servomotors in all types of factory automation, robotics, food processing and medical applications. Here, motors control machine movements, but when power is cut off—either intentionally or accidentally—in many designs, the motors can’t hold machine axes in place,” said Frank J. Flemming, president of Ogura Industrial Corp.

Engineers use holding brakes here because as soon as power is removed from the brakes, either a permanent magnet or a series of springs actuate to stop the motor shaft from moving. That makes for an interesting development in technology use.

“Although there’s been a decline in traditional clutch and brake functions in machinery, there’s been significant increase in demand for more holding brakes. Most industries want smaller motor modules with increased torque,” said Flemming. “This has put pressure on brake manufacturers to design smaller but stronger-holding brakes to meet motor-manufacturer requirements.”

Others in the industry agree. “Although motor and drive technology has reduced some traditional factory automation and packaging wrap-spring and friction-clutch brake use, there’s more growth in medical, aerospace and defense, and automotive segments. Actually, growth in those markets has more than offset the decline in traditional industries,” said John Pieri, product linear manager of clutches and brakes at Thomson Industries. More after the jump.

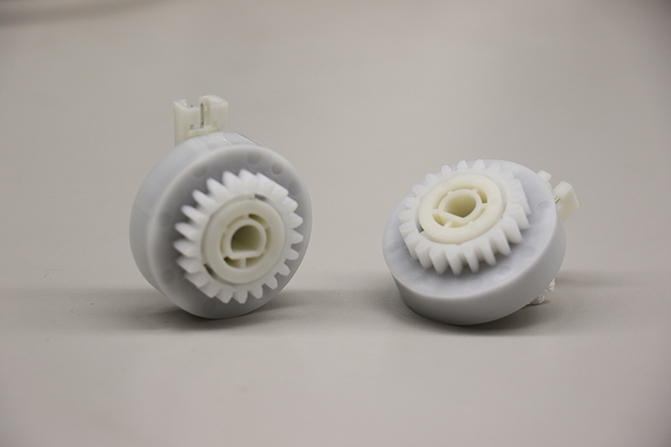

On another front, new designs in office equipment (such as network printers and copy machines) are driving demand for smaller, lighter and less expensive components. Printer manufacturers in particular are continually looking for product improvements. So just a few years ago, Ogura developed a high-torque microclutch using a triple-flux-path design and a combination of powder metal and plastic parts to deliver high torque at low cost for such printers.

“Our new MIC-3.5T clutch helped create a smaller and lighter printer, which reduced the overall cost to the consumer,” said Flemming. The MIC-3.5T is an example of a new design that didn’t exist 10 years ago; it has 70% more torque and is 30% thinner (and 50% less expensive) than equivalent clutches 10 years ago. This is mainly because the equipment to produce the component parts of this clutch didn’t exist a decade ago.

But the industries of medical, aerospace and defense (A&D), and automotive are spurring more clutch and brake change, according to Pieri. Case in point: The medical market is growing with the boom in personal-mobility equipment for aging populations. What’s more, A&D and automotive applications are using more electromechanical equipment (that necessitate clutches and brakes) as they phase out hydraulic actuation.

Consider a specific example. “We have a newer application working in an horizontal aircraft stabilizer that in the past was operated by hydraulic actuation,” said Pieri.

“10 years ago, that was impossible. E2E played a major role in solving technical issues of the airplane manufacturer.”

Others concur that A&D is changing the use of clutch and brake technology, as an array of designs are moving from hydraulics to electromechanical actuators. According to Rocco Dragone, senior sales and application engineer at SEPAC, engineers are replacing hydraulically driven actuators in A&D designs (and using more clutches and brakes) for a variety of reasons:

Hydraulics are messy and their components (including hydraulic accumulators, motor pump systems and associated plumbing) are hard to keep sealed. Electromechanical systems eliminate these components so require less maintenance, too. Electromechanical systems have a longer mean time between failure (MTBF), as they incorporate fewer components and no high-pressure lines.

Hydraulic systems are larger and occupy more room than electromechanical systems. Plus, the wires of an electromechanical system are significantly smaller, flexible and more resistant against higher temperatures than hydraulic circuitry. That makes them less of a target for destruction in A&D applications such as fighter jets.

Electromechanical systems are quieter—an important trait for military vehicles.

A typical electromechanical system yields better control over motion profiles.

Electromagnetic clutches lend themselves to IoT functionality

Electromagnetic clutches also lend themselves to remote monitoring. Such clutches can receive the same electric signal and engage after a trigger with a button next to the machine or through a browser-based IoT connection from miles away.

“Without going into too much detail, such clutches can deliver soft starts or over-excitation functions. Here, the clutch can either engage slowly or accept a voltage spike to engage quickly,” said Flemming.

Depending on the machine and feedback it sends to an operator, this function can be remotely controlled. Every time an electric clutch or brake engages, controls can monitor that electric signal. That’s because clutching or braking always produces energy that (based on inertia and speed) can go into a formula to estimate wear, according to Ogura engineering staff. So, if controls monitor a clutch or brake remotely (as they already do on some Bluetooth-enabled applications) they can feed cycle rates back to an equipment dealer. Then dealers can tell customers when clutches or brakes need replacing before failures occur. So even electric clutches or brakes without inherent circuitry for cloud-enabling technologies can easily incorporate into equipment control modules for OEMs.

“The lawn and garden industry is already using such functionality to provide real-time feedback on machine performance, service requirements and malfunctions of components,” said Flemming. “Information goes back to the owner, dealer or distributor.”

Miniaturization: Central to many clutch and brake trends

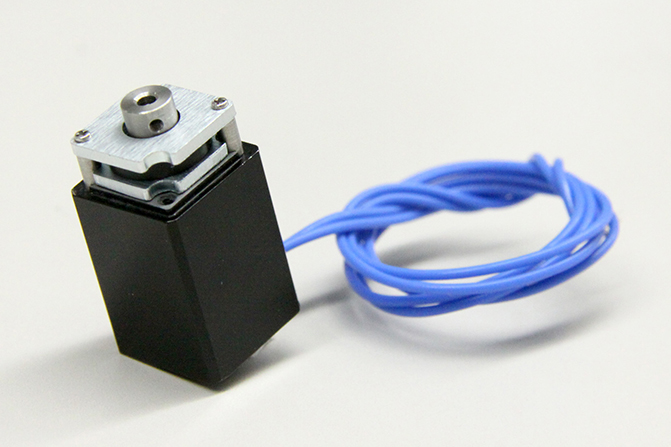

Electromechanical systems are also shrinking as engineers push designs to their limitations, said Dragone. “To keep up with the latest design trends, SEPAC has developed miniature tooth clutches and power-off brakes with diameters of less than 1.3 in. to complement today’s smaller actuators in packaging, robotics, medical, and oil and gas designs.”

Many servomotor manufacturers have also asked Ogura to devise new miniaturized holding brakes for motors in medical equipment, according to company engineers. The brakes also find use in the semiconductor-manufacturing industry, so as that market grows, use of clutches and brakes also grows.

Outsourcing design applies to clutches

A trend application engineers at Ogura have seen over the last 10 years—one that looks to continue—is that fewer OEMs are spending time developing their own clutches and brakes. As more OEMs function with less engineering staff, those engineers have less time to search for new products, so rely on existing vendors to meet their application needs.

“Companies having a broad spectrum of clutch and brake experience offer knowledge to assist engineers with their design requirements,” said Flemming. Many times engineers think they need a special design, but with some companies offering more than 3,000 standard clutch and brake designs, something for the job may already exist, he added. In short, a special clutch or brake is not always as special as a customer thinks.

The burden of quality control and performance has shifted almost 100% to the supplier, so OEMs rely on supplier’s manufacturing and outgoing inspection to meet end user needs. “Here, suppliers must meet internationally recognized ISO requirements and must pass customers’ stringent quality-control requirements,” said Flemming. Such quality control is paramount in the medical and automotive industries—as well as A&D.

“In the world of A&D, we specialize in making tooth clutches and power-off brakes for unique applications requiring custom solutions,” said Dragone. “For example, 10 years ago, a tooth clutch wasn’t considered unless rpm was less than 3,600—but today, we manufacture tooth clutches that run at speeds exceeding 10,000 rpm and power-off brakes that can handle speeds to 20,000 rpm.” Dramatic advances in modern design software and manufacturing techniques have contributed to the ability to produce clutches and brakes far superior to previous iterations, added Dragone.

“Automation lets us produce consistent high-quality components, so where it makes sense, and given the choice, we choose automation,” agreed Flemming.

Automotive examples: Clutches boosting efficiency

This Motion Trends article focuses mainly on industrial applications for clutches and brakes, but those for automotive applications (in the vehicles themselves) are driving new innovations, even for traditional internal-combustion-type cars.

“In general, we are seeing a trend in onroad and offroad vehicles to remove parasitic loads when not needed. Even though the cost of gasoline and diesel have declined this year, the trend in increasing efficiency and decreasing fuel consumption has not declined,” said Frank J. Flemming, president of Ogura Industrial Corp.

Flemming’s company sells electromagnetic clutches for an array of engine-driven components—for example, air-conditioning compressors. Such compressors only run when needed, so an electromagnetic clutch on the front of the compressor engages the compressor depending on vehicle cabin-temperature requirements. When not needed, the electromagnetic clutch simply disengages and the compressor does not turn. Electric clutches now work on other belt driven engine components such as generators, vacuum pumps, hydraulic pumps, water pumps and even alternators as well.

Besides decreasing parasitic loads, today’s Ogura clutches increase engine performance, too. By using a smaller size engine and adding a supercharger or a turbocharger to that engine, engine horsepower increases only when needed, so makes for a more fuel-efficient vehicle overall. Ogura clutches on superchargers engage the supercharger at low speed and then disconnect it at high speed (where the turbocharger then kicks in). This boosts both low and high-speed vehicle performance, according to sales-management staff at Ogura Industrial.

Leave a Reply

You must be logged in to post a comment.