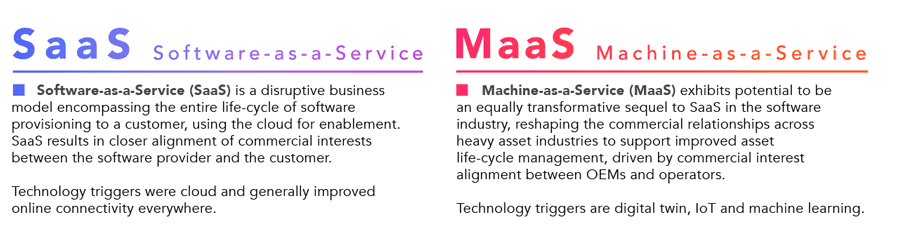

Most of us are familiar with the software as a service (SaaS) business model, in which users pay a fee to access software over the internet, without requiring an application or download to a local machine. The software as a service model made complex software, such as CRM (customer relationship management) systems, more accessible to small business, thanks not only to a more manageable subscription-based pricing structure but also by removing the necessity for specialists to install, update, and manage the software in-house. In the manufacturing space, a similar concept, known as a machine as a service (MaaS) is taking hold.

The machine as a service business model (also referred to as Equipment as a Service, or EaaS) offers some of the same benefits to manufacturers, including low or no capital expenditure, with upgrades, service, and maintenance handled by the machine builder (OEM). And while the MaaS business model has been around since the 1960’s, when Rolls Royce began offering aircraft engines on a fixed cost-per-flying-hour basis, interest has grown in recent years, especially given the unprecedented labor shortages and supply chain issues that manufacturers have experienced during the COVID-19 pandemic.

Image credit: Oilman Magazine

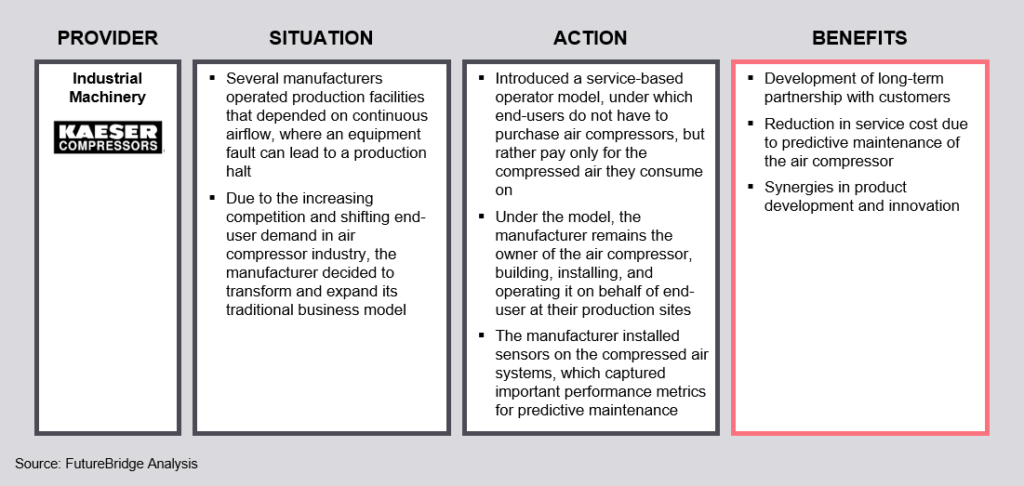

One of the biggest challenges for OEMs looking to implement the machine as a service model is determining a cost structure that is beneficial — and manages risk — to both the user and the OEM. Although variations exist, most MaaS agreements are built around one of two basic models.

- The OEM sells the machine to the user at a cost much lower than that typical of an outright sale. Then, for each item produced by the machine, the OEM receives either a fixed payment or a percentage.

- An end user who owns a machine but doesn’t utilize the machine’s full capacity allows other manufacturers to use the machine on a subscription basis.

For small and medium-sized manufacturers — who may not have the capital to purchase equipment outright or the guaranteed, consistent demand to justify the expenditure — the machine as a service model can put expensive capital equipment within reach, making additional production capacity feasible while minimizing some of the risk of an outright purchase. And because the machine OEM is responsible for maintenance, service, and upgrades, manufacturers don’t need in-house expertise or resources for these tasks. Unlike a traditional rental contract, the MaaS model insulates the manufacturer from expensive payments on unused capacity if demand falls, shifting this risk to the OEM.

For the OEM, the machine as a service model shifts what would traditionally be a one-time machine sale into a recurring revenue stream over the machine’s lifetime. And because the OEM maintains the machine, this model strengthens the OEM’s ties to the user, giving the OEM a better platform from which to offer additional services and products.

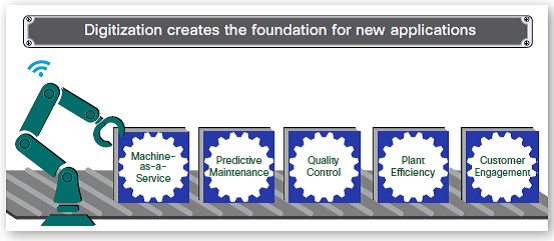

For OEMs in particular, the success of the MaaS model relies on technologies such as IIoT connectivity, edge computing, and digital twins. These connected technologies allows OEMs to track and monitor machine usage (for accurate, transparent billing), and to do so in real-time. They also make it possible to collect detailed performance data, which can be used by the OEM to execute predictive or preventive maintenance and to determine when upgrades are appropriate. Performance and operational data can also be aggregated across multiple machines in the field to drive product upgrades and new product developments that are relevant to the market.

Image credit: FutureBridge

Of course, the machine as a service model isn’t a good fit for highly custom or specialized equipment. The best fit are machines that perform a single function or small group of functions — such as machining centers and palletizing equipment — and that can be easily integrated into an existing production facility and workflow. Robots — and cobots in particular — have proven to be ideal for this business model. In fact, alongside the MaaS model, a related business model, known as robot as a service (RaaS), is also gaining acceptance in the manufacturing space.

Feature image credit: Cisco

Leave a Reply

You must be logged in to post a comment.