This year in motor design there’s been an uptick in three trends. Disposable medical devices, new consumer products, and the automation of humbler tasks are driving demand for affordable and miniature-motor options. (Read more about motor miniaturization in the second installment of this two-part Motion Trends series on electric motors here.)

This year in motor design there’s been an uptick in three trends. Disposable medical devices, new consumer products, and the automation of humbler tasks are driving demand for affordable and miniature-motor options. (Read more about motor miniaturization in the second installment of this two-part Motion Trends series on electric motors here.)

A related trend towards compact designs is leading hand-tool applications. There’s also escalating use of servomotors and direct-drive motors for appliance, automated guided vehicle (AGV), and e-mobility applications.

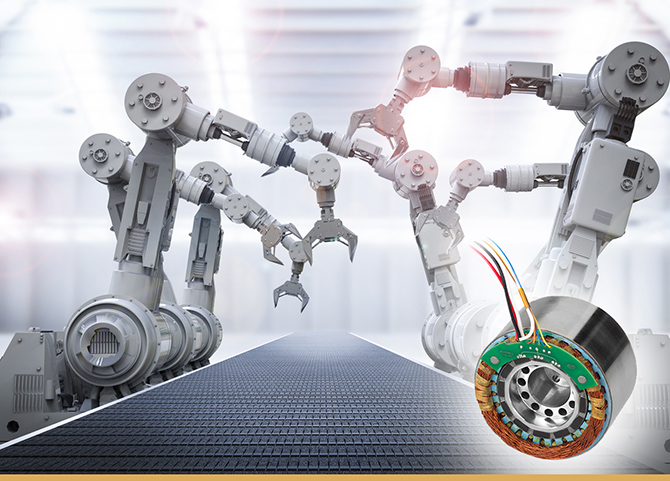

Motor design itself is evolving to satisfy pressures brought by globalization — including high-throughput manufacturing with expectations for accuracy and reliability. Here, many applications where servomotor designs were once overkill are now using such setups to boost efficiency — especially where load-responsive motion control or positioning is a design requirement. In fact, servomotors and new breeds of closed-loop stepper motors now run more axes than ever in machines for packaging, semiconductor manufacturing, and robotics. Synchronous motors are also on the rise in all sizes thanks in part to steady rare-earth element prices for the supply of permanent magnets.

“ABM DRIVES launched the Sinochron PMAC motor line a few years ago. This highly efficient technology allows 30% reduction of the drive footprint with identical performance to an ac induction motor — and with an efficiency improvement of 10 to 15%,” said Gabriel Venzin, president at Cincinnati-based ABM Drives.

No matter the type, motor-driven designs are increasingly pre-integrated (both physically and on the controls side) to simplify or even eliminate setup. “We offer gearboxes with integrated lead screws to reduce part count and avoid issues that arise from twisting in the coupling,” said Biren Patel, motion control engineering manager, maxon precision motors. The manufacturer also offers motors with integrated controllers: “We started with our dc brushless (EC) flat products and are working towards making the option in additional brushless categories … and offer custom mechatronic solutions as well,” said Patel.

Others also note the rise of manufacturer engineering for upfront customization.

“We see demand for turnkey setups in which motion suppliers do more of the system design and software development,” agreed Carter Greene of Dunkermotoren. The manufacturer offers motion hardware and software for several levels of configurable solutions. “Our modular design concept boosts flexibility to let specifying engineers use different drives but stay within a set footprint,” explained Greene.

So then OEMs can provide several options to end users while maintaining common manufacturing components and practices in their own facility. It’s typical for the manufacturer to review OEM and end-user applications and analyze required move profiles to then design custom motor-gearbox-electronics-software packages for single and multi-axis requirements.

They’re not alone: Other motor manufacturers support design engineers with system-level assemblies and complementary drives and controls to get more out of a given motor setup. Case in point: MICROMO of the FAULHABER Group (founded on the development of coreless-micromotor technology in 1947) does this with coreless and brushless dc motors; stepper and piezo motors; precision gearheads, linear actuators and custom system-level designs. One example is the high-bandwidth MC3/MCS motion controller that gets maximum performance from FAULHABER motors (and comes with an EtherCAT interface). MICROMO coreless motors have low inductance, which makes them highly reactive to load changes — and that can be a challenge for some drives and controls. MC3/MCS motion controllers address that. Pairing with feedback options such as analog hall sensors lets the controllers leverage a cost-effective approach to high-resolution position control in a way that other controllers can’t do.

Semiconductor, robotics, assembly (yes, and material handling) need smart affordable motors

Current design objectives in most industries (besides lower cost) are throughput, flexibility, and reliability. “Almost without exception, every industry is changing how they view motion,” said Greene. That’s partly because increasingly complex automation (and move profiles for specific tasks) as well as demand for efficient designs are spurring end users to ask suppliers for more flexible machine builds — and customers are looking for suppliers that can add value to their process, he added.

“Whether it’s simple application support or providing an out-of-the-box and onto-the-machine solution that eliminates manufacturing, we aim to help OEMs make better product,” said Greene. “Collaboration is key to leveraging supplier experience — especially when the scale of a project is large.”

That’s certainly the case with increasing automation in warehouse settings and automated storage and retrieval systems (ASRSs) that use centralized controls to automatically place and retrieve items from storage with hundreds to thousands of motor-driven axes.

“One of the most striking changes we’ve seen is in the material-handling market,” said Greene. ‘I need it now’ consumer attitudes and the growth of large distribution warehouses to serve new buyer trends mean product must move faster than ever. “That and huge variations in product types to be picked from shelves and comingled into shipment boxes equate to enormous need for reliable coordination of complex tasks to pace with demand,” he added.

Electric motors in these settings run lifts, conveyors, AGVs, packers, stackers, labelers, and robots.

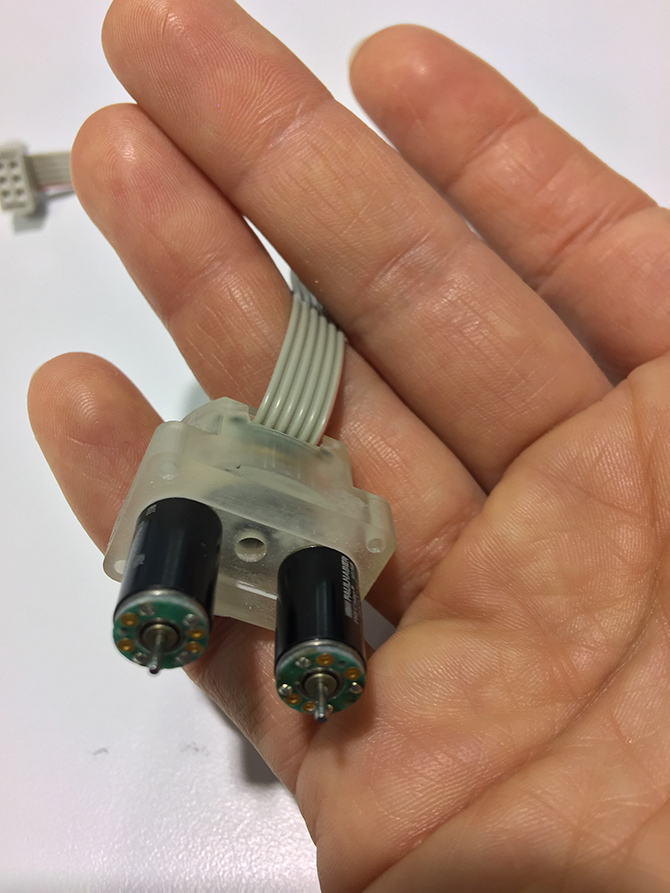

“Motors used in material-handling equipment and these modern-day robots must be extremely reliable and cost efficient,” said Matt Lesniak, Sensata Technologies V.P. of Industrial Solutions. One Sensata offering in this area is a BEI Kimco frameless brushless dc (BLDC) motor to fit into the tight volumes of light-robot joints and other machines. Robotic technologies first developed for military and aerospace applications now work in new industrial applications because new material sourcing and cost-efficient manufacturing have made them more economical, according to Lesniak.

Another example is the design of an AGV from Ontario-based ADAM. Billed as an autonomous mobile robot (AMR), the vehicle transports items from random origins to random destinations using a PC for control, laser range-finding for navigation, and two independent servomotors with integrated gear reducers in its drive.

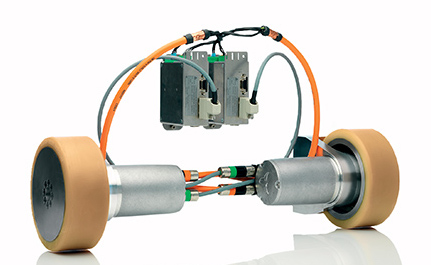

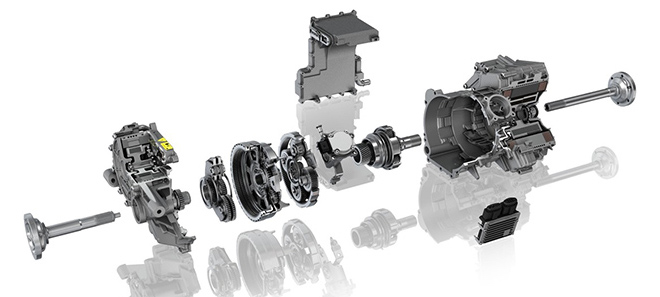

In fact, some motor suppliers serve the burgeoning AGV market with complete powered-wheel assemblies. Consider the Wittenstein iTAS — a modular servodriven wheel axis specifically for AGVs.

Its twin servomotors include helical low-backlash planetary gearheads and VULKOLLAN wheels. The gearmotors deliver wide tilting moments, good speed range, and power density (with the latter critical for flat AGVs that lift and move fleets of unmotorized trolleys from below). One two-wheel iTAS axis uses a simco servo amplifier (accepting input from 12 to 60 Vdc) to coordinate motion through high-resolution current control and sensing; steering happens through a speed difference between the two drives. IoT connectivity through an onboard web server lets users track servo-amplifier operation as well as driving status.

The design challenges of AGVs clearly share some commonalities with those of autonomous vehicles. According to Jeff Hemphill, V.P. and Chief Technical Officer of the Schaeffler Group North America, two main trends are driving concurrent symbiotic acceleration — designs for autonomous vehicles as well as e-mobility. Electric mobility (e-mobility) refers to vehicles with electric-powered drivetrains (as well as smart grids to support fleets’ power demand) instead of vehicles with internal-combustion engines running directly off fossil fuels.

“We’ve put a lot into e-mobility research and production. We’ve also devoted R&D to products such as actuators for autonomous and connected vehicles, because whenever you make an autonomous vehicle, you must essentially provide a miniature robot to execute the physical tasks a human would have done,” explained Hemphill.

“These two trends are spurring each other, because autonomous vehicles will probably excel as shared or on-demand vehicles, as they’ll have much higher utilization. Here, electric drivetrains (though initially more expensive) could ultimately lower total cost of ownership.” That’s partly because electricity is about a fourth to a third of the cost of gasoline depending on location. Plus electric vehicles need less maintenance.

“So for example, future operators of shared robo-taxis will want electric robo-taxis for how they’re easier and cheaper to keep running,” said Hemphill.

Exploding uses for direct-drive motors in e-mobility applications

Vehicles have come to dominate the annual Consumer Electronics Show to the partial detriment of the North American International Auto Show (the Detroit Auto Show). Many automotive OEMs are unveiling their designs in Vegas instead of Detroit due to the increasingly electric and electronic nature of their designs.

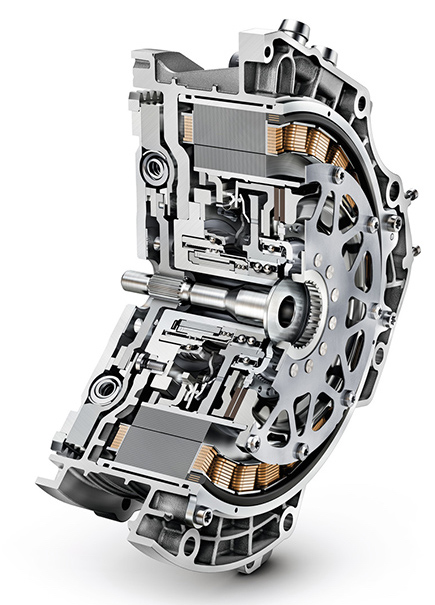

“Schaeffler Group has existing products and partnerships enabling further development. Case in point: We currently produce hybrid modules for the Nissan Fuga (an Infiniti in the U.S.) and versions of the Porsche Cayenne,” said Hemphill. The company also makes other components to support hybrid engines and transmissions — including everything from cam phasers to specialty vibration-absorbing dampers. “We also have a lot of integrated hybrid modules in the pipeline — as well as complete electric axles for battery-powered or even hybrid electric vehicles. In fact, to supply motors to the automotive market, we just purchased Compact Dynamics, which makes high-performance electric traction motors.”

Traction motors are those moving vehicles. Right now most traction-motor applications are in automotive or light vehicles. “We currently have a four-wheeled bicycle we call a micro-mobile that has an electric motor that can help or totally propel the bicycle — or the rider can pedal it,” said Hemphill. Schaeffler Group produced its own electric motors before, but mostly for industrial applications such as machine tools.

To serve e-mobility design, Schaeffler Group signed a cooperation agreement with Compact Dynamics’ former parent company that makes power electronics.

“That’s because an increasing number of hybrid modules and electric axles need integrated power electronics. So we’ll need the ability to build complete designs into single housings and test and ship them as complete mechatronic units,” Hemphill added.

In fact, one enabling technology allowing the trend towards autonomous vehicles is the ever-decreasing size of electronics — including power electronics that are smaller and smarter than ever.

On the mechanical side, it’s increasingly tight integration that’s driving innovation for e-mobility. “Schaeffler Group today does a lot of integration upfront. Our roots are in the manufacture of classic mechanical components such as bearings and rivets and sheet-metal parts. These are all needed in advanced designs such as electric axles and hybrid modules. Because we still produce those mechanical parts, we have an advantage when we go to integrate them into bigger systems,” said Hemphill.

Consider how the company is working on a hybrid module right now — a launch device and disconnect clutch and electric motor that go between an engine and transmission to convert regular vehicles into hybrids. “With a high level of integration, we made the design 50 mm shorter than what the customer even needed, because we combined the mechanical components so well. Batteries and electronics are getting cheaper and smaller, but this design shows we’re also devising ways to combine mechanical designs more elegantly — to make them more affordable and more functional,” added Hemphill.

In fact, that’s a common trend to satisfy design engineers asking for pre-engineered solutions or integration from manufacturers in all industries.

When asked for additional examples of integrated design offerings, manufacturers had many. “Schaeffler Group recently designed a lightweight differential that arose out of our background in making bearings and pins for planetary gear sets. Now we integrate those with a planetary gear set to give the reduction for an e-axle,” explained Hemphill. “Or reconsider the hybrid module we make. We make not only its bearings but also its torque converter. In fact, we combined the torque converter and electric motor into one assembly there.”

When pressed to predict the future of e-mobility, Hemphill noted that it will depend whether prices for batteries and power electronics continue to fall. “But I think in 10 years we’ll still have myriad powertrains — with purely electric vehicles more for daily-driver applications. That’s because many people will still have long commutes. I personally drive to Detroit once a week, and would prefer a plug-in hybrid for that. But I think there will be a lot of diversity in designs for over-the-road trucks, efficient combustion engines, and maybe even fuel cells.”

Something on the horizon in all applications is the rise of IoT. “Within vehicle applications we’ll see that in connected and autonomous vehicles that link into vehicle infrastructure,” said Hemphill.

“We also see the rise of IoT on the manufacturing side, especially in setups for machine tools. What’s more, we’ve amassed a huge library of computational models over the years, which we now use to create digital twins of physical parts. So say we sell a bearing into a wind turbine. Here we can now exchange data with the wind-turbine operator and run our computation models in the background. Then we can warn the operator, ‘You’ve got three months left on that bearing, so you need to order another. By the way, here’s the upgraded one we designed in the meantime.’ Such informed exchanges will only become more common as electronics and computational power are so cheap these days,” explained Hemphill. • Read the second installment of this two-part electric-motor Motion Trends series here.

Leave a Reply

You must be logged in to post a comment.